Why Traders Fail Prop Firm Challenges

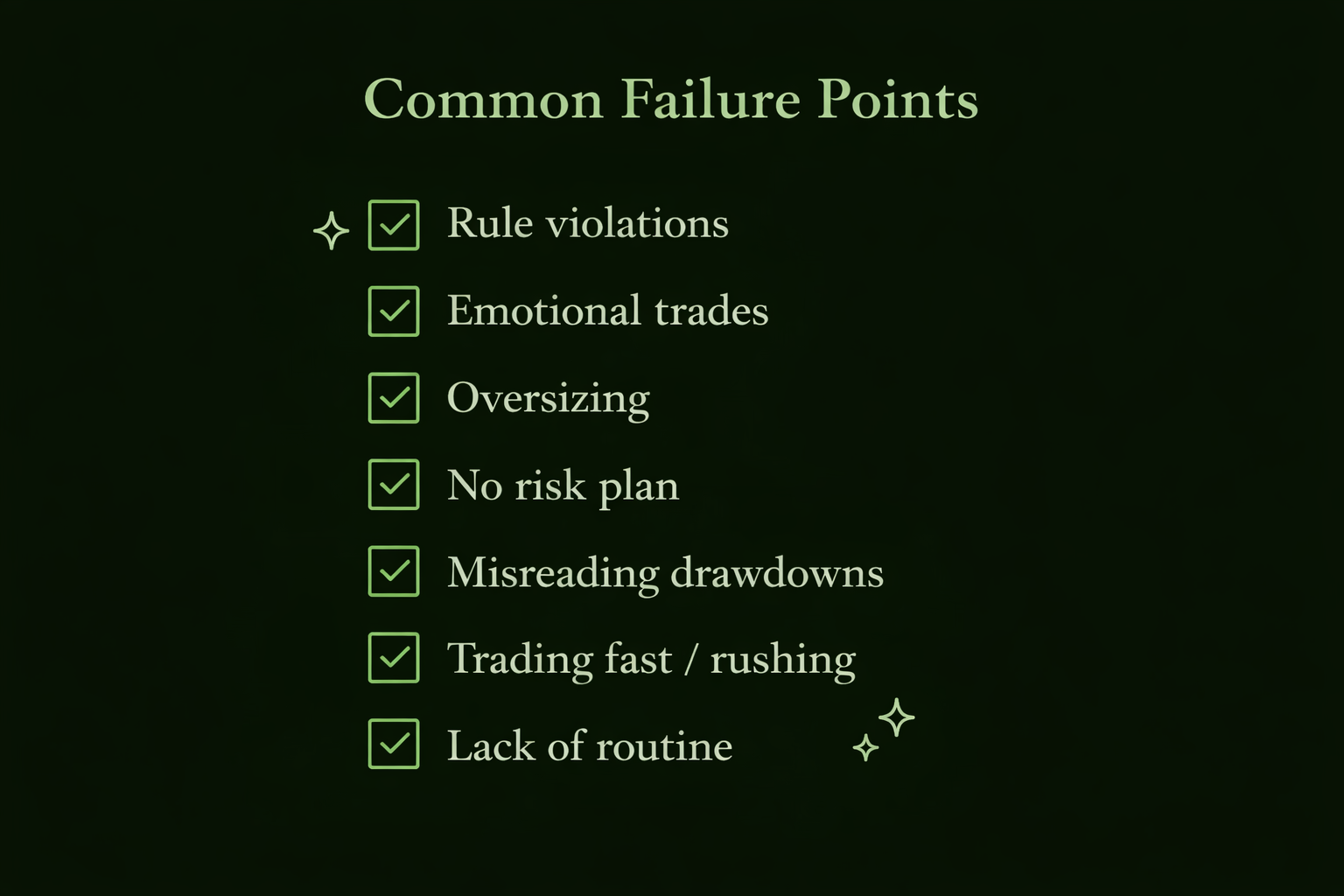

Discover why traders fail prop firm challenges, from rule violations and emotional trading to oversizing and drawdown mistakes, and how to avoid these costly errors.

Why traders fail prop firm challenges is a question that continues to surface with the rise of funded trading programs. Prop firms provide access to capital, but they expect traders to follow rules and trade with discipline. Even skilled traders fail evaluations not because they lack chart-reading skills, but because they break rules or push risk beyond limits. Understanding the reasons behind failed challenges can change how traders approach funding and create a path toward long-term payouts.

The Most Common Cause Is Rule Violation

Prop firms enforce rules to protect capital, so failing to follow those rules ends more challenges than blown balances.

Daily Drawdown Errors

Many traders ignore the daily max loss. One bad trade turns into several as they try to recover, and the day ends early with a violation.

Overall Drawdown Breaches

Overleveraging or stacking positions without a stop pushes the account below the allowed loss line. Once the limit is touched, the account is removed.

News and Timing Restrictions

Opening or holding trades through restricted announcements is an easy way to fail instantly. Even when the trade direction is correct, the violation triggers automatic removal.

Rule awareness and calm execution keep traders alive longer than strategy alone.

Emotional Trading Leads to Fast Account Loss

Traders face pressure from inside challenges. The mix of targets, time expectations, and account conditions often leads to emotional choices. Chasing losses, forcing revenge trades, or taking random setups breaks discipline. Prop firms reward traders who stop early and wait for setup quality instead of pushing through frustration.

Oversizing Positions to Speed Up Progress

Many traders believe hitting the target faster means funding arrives sooner. They increase size, hoping for big wins, but large trades also expand risk. Two or three fast losses erase progress and often take the account past limits.

Slow progress beats forcing the challenge.

No Structure or Risk Plan

Traders who pass challenges tend to know their:

• Trade setups

• Stop levels

• Average risk per trade

• Daily limit

• Plan for when to stop

Those who fail often trade without a written plan, react instead of prepare, and lack consistency.

Poor Adaptation to Market Conditions

Markets change tone through the week. Some days trend, some chop, some stall. A trader who executes the same play in every environment often fails. Skill is not enough if the setup does not fit the current price behavior.

Winning traders sometimes sit on their hands and preserve the account instead of forcing entries.

Misunderstanding Static and Trailing Limits

Some firms use trailing drawdowns during evaluations. When traders see profit, they assume the same room for loss still applies. Trailing rules move the loss limit higher and trap traders who give back gains.

Knowing how the drawdown system works prevents accidental evaluation termination.

Two tiny curves or meter graphics emphasizing:

- Static = fixed loss floor

- Trailing = rises with profit → can trap traders giving back gains

Trying to Finish the Challenge in a Rush

Many failures happen because traders insist on finishing in a few days. This leads to:

• Overtrading

• Chasing late moves

• Ignoring reports

• Leaving positions open too long

• Breaking rules

Slow, steady execution passes more challenges than flashy sessions.

Lack of Routine and Process

Successful challenge traders treat the evaluation like professional work. They show up at the same time, trade the same markets, and stick to a plan. Random decision-making and boredom trading ruin funded attempts.

Final Takeaway on Why Traders Fail Prop Firm Challenges

Why traders fail prop firm challenges usually comes down to behavior, not talent. Rule-breaking, oversizing, emotional swings, unclear strategies, and trailing drawdown surprises end more accounts than bad market reads. Master the rules, manage risk with care, and take fewer trades with clearer intent. Doing so turns the challenge from a gamble into a controlled path toward funded status and real payouts.