Upfront Fees vs Pay Later Prop Firms

Compare upfront fee vs pay later prop firms, how each model works, costs, pros and cons, and which funding structure fits your trading style, goals, and risk tolerance.

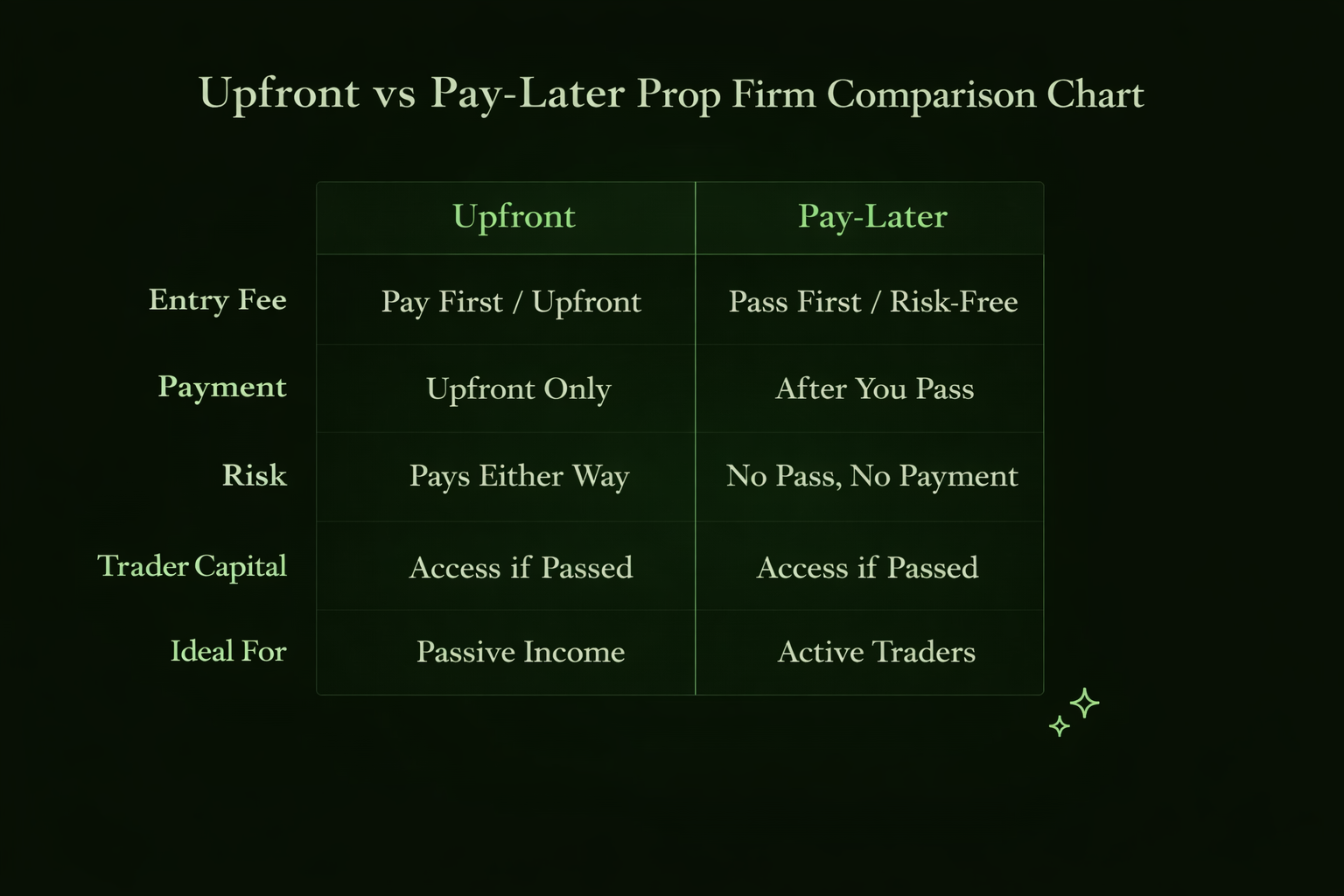

Upfront fees vs pay-later prop firms is a major topic for traders searching for funded programs.Both funding styles give traders access to capital, but the price structure, timing, and long-term financial impact differ.Some models ask traders to pay before trading, while others charge only after the evaluation ends successfully.Knowing how these systems operate helps traders choose the one that fits their goals and protects their budget.

How Traditional Upfront Fee Prop Firms Work

Upfront fee programs follow a simple model. A trader buys access to a challenge and begins trading once the account is activated. This payment varies based on account size and the number of steps in the evaluation.

Payment Structure

• Fee paid before trading

• Evaluation rules enforced

• Passing unlocks funding

• Many firms refund the fee after success

This approach has clear costs, but places risk on the trader early.

Advantages of Upfront Fees

• Known cost at the start

• Fees often returned once funded

• Full payout share begins immediately

• No recurring charges tied to the evaluation

Downsides to Consider

• Money lost if the challenge fails

• Multiple attempts can get expensive

• Pressure builds early if the trader wants to avoid buying another challenge

Upfront firms tend to align with experienced traders who already manage risk well.

How Pay Later Prop Firms Operate

Pay later funding eliminates early spending. A trader joins without a payment and trades through the evaluation. Only after proving skill do fees appear.

When Fees Are Collected

• After passing the challenge

• When activating the funded account

• Sometimes when requesting payouts

• Monthly in some programs

This structure allows traders to test themselves without risking personal funds.

Benefits of Pay Later Models

• No financial downside while learning

• Ideal for repeated attempts

• No stress from losing free money

• Great for testing multiple firms

Drawbacks and Trade-Offs

• Back-end fees may cost more over time

• Some firms reduce payout split early •

Subscriptions may be required to maintain access

• Many pay-later firms are new and need careful vetting

The pay later approach shifts financial pressure to the funded stage.

Total Cost Comparison Over Time

The biggest difference between upfront fees vs pay later prop firms shows up across multiple challenges.

- Upfront model line: cost high on failure, cheap on fast success (early spike)

- Pay-Later line: flat at first, costs rise after success (later slope upward)

Think of two gently diverging curves or bar stacks.

Cost Patterns With Upfront Fees

• Cheap if success comes early

• Expensive if the trader restarts often

• Best suited for disciplined traders

Cost Patterns With Pay Later

• Free to fail

• Higher costs once profitable

• Each payout may carry a hidden share

This explains why confident traders gravitate toward one model, and developing traders favor the other.

How Trading Style Affects the Right Choice

Upfront Fee Model Fits

• Traders with back-tested setups

• People who expect to pass quickly

• Anyone seeking full payout splits from day one

Pay Later Model Fits

• Traders refining strategy

• Those who don’t want to risk cash

• People wanting several trial runs without paying repeated fees

A trader’s stage in development matters more than the model itself.

Other Rules Still Decide Success

Cost model does not change core prop rules. Traders must still manage:

• Drawdown

• Daily limits

• Product restrictions

• News releases

• Account scaling steps

• Withdrawal schedules

The rulebook impacts survival more than the fee.

Looking Beyond Marketing Hype

Some traders jump into firms based on discounts or promotions. Smart traders vet:

• Firm reputation

• Payout reliability

• Customer service

• Rule clarity

• Actual funded trader feedback

The goal is to last long enough to withdraw profit, not just sign up for the cheapest entry.

Final Takeaway on Upfront Fees vs Pay Later Prop Firms

Upfront fees vs pay later prop firms is not about which model is “better,” but which matches the trader. Upfront fees offer a clear structure and can pay off for consistent strategies. Pay later models offer low-risk access and support trial-and-error learning without draining personal funds. Pick the one that protects your mindset and your wallet, and your chances of reaching a funded stage and staying there rise sharply.