Static vs Trailing Drawdown for Funded Traders

Learn static vs trailing drawdown in prop trading, how each limit works, which trading styles they fit, and why choosing the wrong model leads to failed evaluations.

Static vs trailing drawdown is one of the key risk controls used in prop firm trading.When traders apply for funded evaluations, they often look at profit targets, rules, and payout percentages first.Yet the most important rule that determines how long a trader survives is often ignored, and that is the drawdown limit.Knowing the difference between static vs trailing drawdown helps traders decide which prop firm program fits their style, risk limits, and long-term goals.Picking the wrong drawdown model can lead to quick failure, even if the trader is profitable overall.

What Static Drawdown Means

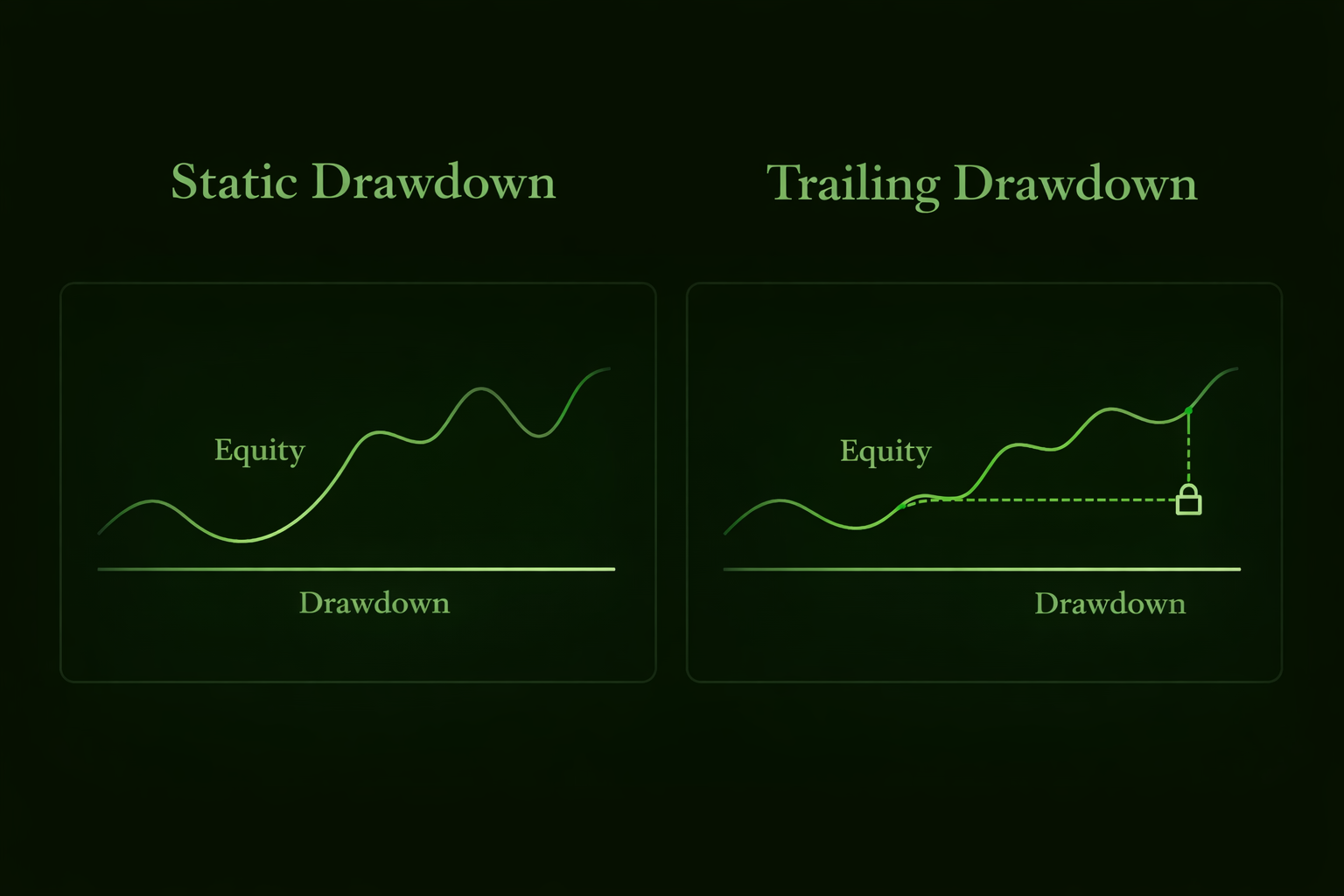

Static drawdown is a fixed number set by the prop firm.Once the loss limit is set, it stays where it is for the life of the account.Static drawdown does not climb when the trader builds gains, and it does not move when profits rise or fall.

Static Drawdown in Real Trading Conditions

Consider a trader with a 100,000 account and a static limit of 90,000. As long as the balance never touches 90,000, the account is safe. If the trader grows to 110,000 and later drops back to 95,000, the account continues without penalty. Profit was earned, but the protected floor remained fixed.

Traders who use wider stop losses or longer holds often benefit from this structure. A swing trader may take a position that goes into early red before pushing toward a target. Static rules forgive that drawdown as long as the floor remains untouched. This setup supports approaches that need room and patience.

Static vs trailing drawdown is more than a small rule difference. Static rules often reduce stress because the trader knows the loss floor does not creep closer as gains build.

What Trailing Drawdown Means

Trailing drawdown begins lower than the account balance and moves upward as profits increase. The drawdown level trails behind the highest balance, narrowing the gap between equity and the loss limit.

Trailing Drawdown Behavior During Evaluations

In a trailing system, a trader starting at 100,000 with a trailing number of 10,000 also begins with a limit at 90,000. If the trader reaches 106,000, the protected level trails to 96,000. If peak equity hits 112,000, the limit climbs to 102,000. The rule protects profits while requiring discipline.

The catch is what happens next. If the balance falls below the trailing floor, the account fails. If gains stall, the loss limit freezes at the last trailed number and does not fall with the balance. Many firms lock trailing limits once they reach the original account balance. At that point, the trailing drawdown becomes fixed like a static drawdown, but the trader must survive the early rising phase before reaching that safety point.

Trailing drawdown rewards stable gains. It suits traders who take small hits, keep losses contained, and produce smooth equity growth rather than large swings.

Static vs trailing drawdown decisions become most meaningful here. The trailing model requires much tighter discipline, and a mistake has less room to unwind.

Static vs Trailing Drawdown: Key Differences and Why They Matter

Static Drawdown Summary

• Loss limit never moves • Profits do not increase the minimum balance • Ideal for methods that have temporary pullbacks • Helps traders who use partial closes and runners • Common for traders with multi-day trade plans

Trailing Drawdown Summary

• Loss limit tracks new highs • Stops trailing when locked at the account start • Suits quick entries and tight stop practices • Punishes large reversals • Forces consistent risk habits

Static vs trailing drawdown alters not just risk limits, but trading behavior. The rule you choose should align with your plan before you even place a trade.

How Static vs Trailing Drawdown Shapes Profit Potential

Many traders talk about payouts, but forget that payouts only matter if the account survives. Static drawdown lets a trader stack gains above a fixed floor. Once a cushion is built, the trader can scale lots or size more comfortably. Trailing drawdown cuts that comfort zone in half because every new peak drags the limit upward.

A trader who is profitable but inconsistent may prefer static rules. A trader who grinds steadily with frequent small wins may find trailing systems manageable. Static vs trailing drawdown affects when you can scale positions, how often you can risk break-even moves, and whether swing trades stay open overnight.

Which Trader Should Pick Static vs Trailing Drawdown

Think about your typical trade record:

• Do you see floating drawdowns often before price moves? Static drawdown gives room.

• Do you cut losses early and stack small wins all day? Trailing drawdown may support that style.

• Do you like to scale into moves with staged entries? Static can handle it far better.

• Do you scalp futures or forex with tight stops? Trailing rules will not feel restrictive if stops are consistent.

Static vs trailing drawdown should always match your natural behavior, not the other way around.

Two columns or a simple flowchart:

- Static works for: swing, runners, staged entries

- Trailing fits: scalpers, tight stops, small consistent wins

Why New Traders Fail Because of Drawdown Rules

A trader may hit profit targets and still lose the account because they misunderstand drawdown enforcement.Trailing drawdown is especially known for early evaluation failures.A trader may reach strong profits, then give back gains during a reversal, and hit the tightened loss floor.

In contrast, traders using static drawdown may survive downturns and recover because their buffer stays intact.

Static vs. trailing drawdown can make or break even the most skilled strategy.Knowing the difference protects your capital and keeps you in the prop firm program longer.

Final Takeaway on Static vs Trailing Drawdown

Static vs trailing drawdown is a core factor in funded trading success.Static drawdown creates a fixed level that remains constant throughout the evaluation or live account.Trailing drawdown climbs behind new equity highs until it locks, demanding steady performance and tighter control.

Before selecting a prop firm, compare drawdown style, risk rules, and how those rules support your method.The right drawdown choice increases the chance of passing evaluations, keeping accounts alive, and withdrawing real profits over time.