Prop Firm Profit Split Explained

Understand prop firm profit splits, how 70/30, 80/20, and 90/10 payouts work, what affects percentages, and how rules, scaling, and fees impact what traders keep.

Prop Firm Profit Split Explained is one of the most important topics traders should understand before signing up for a funded program. Prop firms offer access to trading capital and return a portion of profits to the trader once funding is earned. While many companies advertise attractive profit splits such as 80/20 or 90/10, the real structure behind payouts varies based on rules, trading performance, and account milestones. Learning how the split operates helps traders avoid surprises and choose the firm that supports their trading approach.

What a Profit Split Means in Funded Trading

A profit split is the percentage division of profit generated inside a funded account. Because the firm supplies capital and assumes loss exposure within limits, the firm keeps a portion of the earnings and gives the rest to the trader.

This percentage defines how much income a successful trader can withdraw from their funded trades.

Why Prop Firms Use Profit Splits

Without profit sharing, firms would risk money without reward. The split model aligns interests:

• The firm provides the funded capital

• The trader supplies skill

• Both benefit when profit is made

Since a firm allows losses only within strict drawdown limits, splits help offset losses across traders while letting profitable traders thrive.

Common Profit Split Tiers Across Firms

Not all firms pay the same, and payout tiers often match trader stages.

70/30 Splits

Often used during first payouts or for traders new to the company.

80/20 Splits

A widely used standard among long-running firms.

90/10 and Higher

These splits are usually reserved for:

• Traders on funded accounts

• Traders meeting minimum payout requirements

• Traders scaling into larger capital levels

A few firms promote 95/5 splits, but those usually come with tighter entries, restrictions, or higher fees.

How Profit Splits Change Over Time

Prop firm payout structures are rarely static. A trader’s split percentage may improve based on consistent performance.

Evaluation Phase

No splits or payouts until the evaluation is passed.

Early Funded Stage

A lower split may apply until a trader completes the first withdrawal.

Long-Term Funding

Many firms raise splits once consistency is proven. A trader may start with 80/20 and shift to 90/10 after several profitable cycles.

Scaling and performance often unlock better percentages.

What Affects Split Possibilities

Firms consider several factors when setting profit splits:

• Account size

• Fee model (upfront vs pay later)

• Whether the firm pays commission rebates

• Risk type (trailing vs static drawdown)

• Cost of evaluation attempts

• Whether the account is scaling or at base size

Larger splits tend to come with stricter rules or higher evaluation fees.

How Payout Calculations Work

Payouts are usually based on the closed profit within the funded account. Some firms include fees or rebates in the calculation, while others do not.

Most firms release payouts through:

• Bank wires

• Crypto networks

• Digital payment platforms

First payouts may require:

• Minimum profit thresholds

• A certain number of days traded

• Rule compliance across the payout cycle

Failure to follow rules voids any pending payout.

Frequency of Profit Distributions

Payout opportunities differ by firm.

Typical schedules:

• Weekly payouts

• Bi-weekly cycles

• Monthly payout windows

• First payout after 30 or 45 days, then faster cycles

Shorter payout cycles benefit active traders. Longer payout cycles may suit slower, controlled styles better.

Why High Splits Are Not Always Best

A 90/10 split looks better than 80/20 on paper, but money kept depends on:

• Account size

• Ability to stay within drawdown

• Firm rules

• Whether multiple payouts are earned before a failure

A cautious trader earning steady payouts on an 80/20 may collect more long-term than a reckless trader chasing a 90/10 and losing funding.

Impact of Scaling on Profit Splits

Some firms give higher profit splits and larger capital access once traders hit certain performance points.

Scaling models may:

• Multiply account size

• Increase monthly payout allowance

• Raise split percentage

• Loosen limits once funded status matures

A trader with a $25K start can grow into $100K or more if results stay consistent.

Fees That Affect What Traders Keep

Profit splits interact with costs.

Possible deductions include:

• Upfront evaluation fees

• Funded access fees for pay-later firms

• Platform or data fees

• Withdrawal processing charges

• Subscription renewals for payout eligibility

A split of 90/10 is less meaningful if recurring costs eat into the 90%.

What Traders Should Inspect Before Joining

Smart traders review:

• Whether withdrawals reduce account drawdown

• How many payouts must occur before scaling

• Whether inactivity affects payout rights

• Whether the trailing drawdown applies during payout months

• Whether firms require minimum lot sizes or trade days

Fine print matters more than marketing claims.

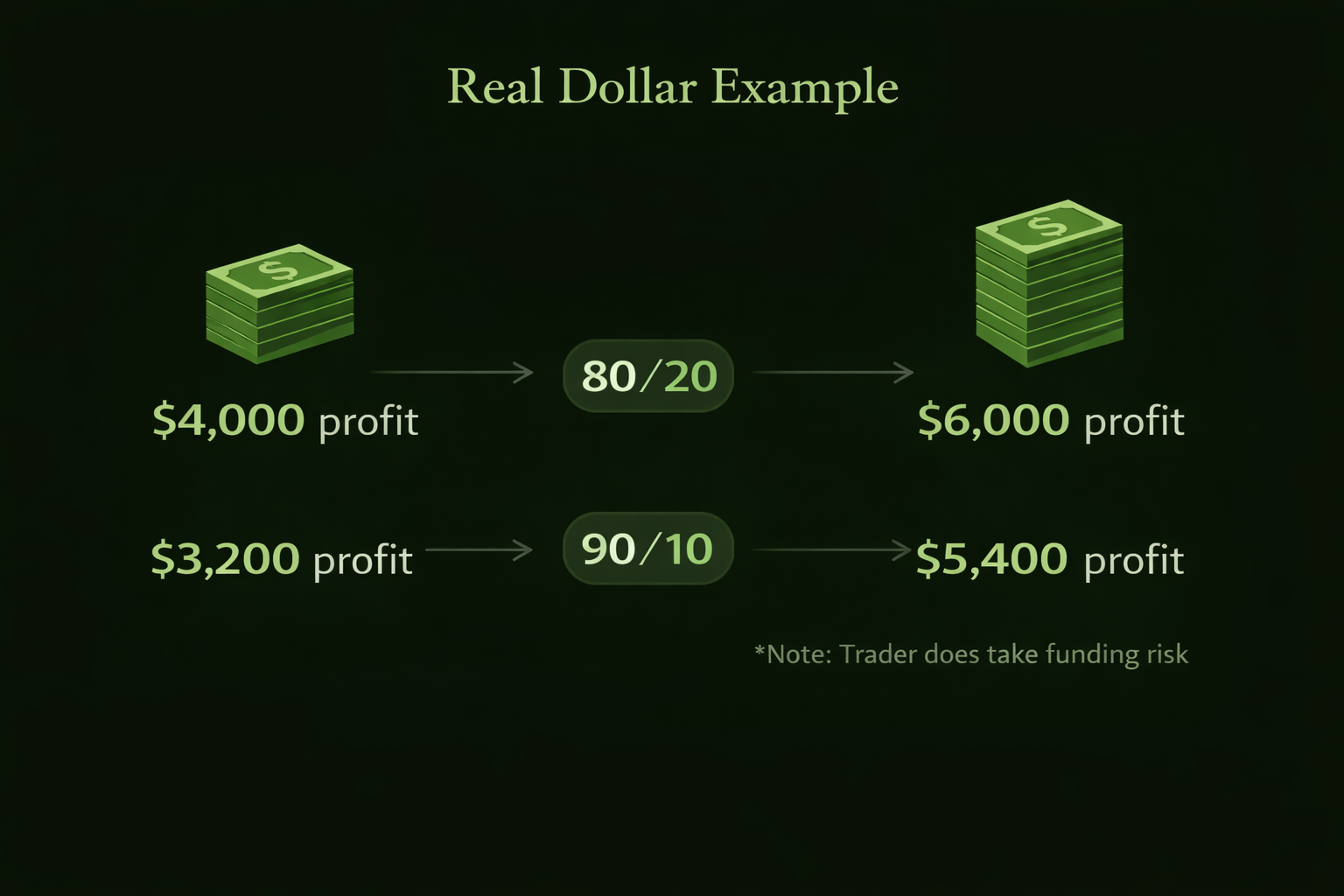

Profit Split Examples That Show Real Scenarios

Example 1: Conservative Trader Earns $4,000 with an 80/20 split → takes home $3,200 Maintains account and builds long-term payout potential

Example 2: Aggressive Trader Earns $6,000 under a 90/10 split → takes home $5,400 But blows the account next month → loses all future potential

Steady performance often wins more over time.

Final Takeaway on Prop Firm Profit Split Explained

Prop Firm Profit Split Explained gives traders insight into how payouts really work once funding begins. Firms share profit because they supply capital and carry the financial exposure, while traders provide skill and discipline. Split percentages matter, but survival, rule-following, and consistent profit generation matter more. Choose a firm with a payout model you understand, protect the account, and a fair profit split becomes a real opportunity to grow trading income responsibly.