Prop Firm Drawdown Rules

Learn prop firm drawdown rules—static vs trailing limits, daily loss caps, equity vs balance tracking—and how to protect your funded account and avoid violations.

Prop firm drawdown rules are the single most important factor in whether a trader survives a funded challenge or loses access early.These rules decide how much loss is allowed, how deep positions can pull back, and when a trader must step aside before breaking limits.Whether you trade forex, futures, or indices, prop firms enforce drawdown boundaries to protect their capital and filter for disciplined traders.Understanding these rules is a major advantage and often more valuable than having a strong strategy alone.

The Role of Drawdown in Prop Firm Trading

Drawdown marks the maximum amount a trader can lose from the starting balance or from the highest point of equity. Unlike personal accounts, funded programs do not allow recovery after hitting the limit. One breach, no matter how small, and the account shuts down or resets. This makes risk planning more important than forecasting market direction.

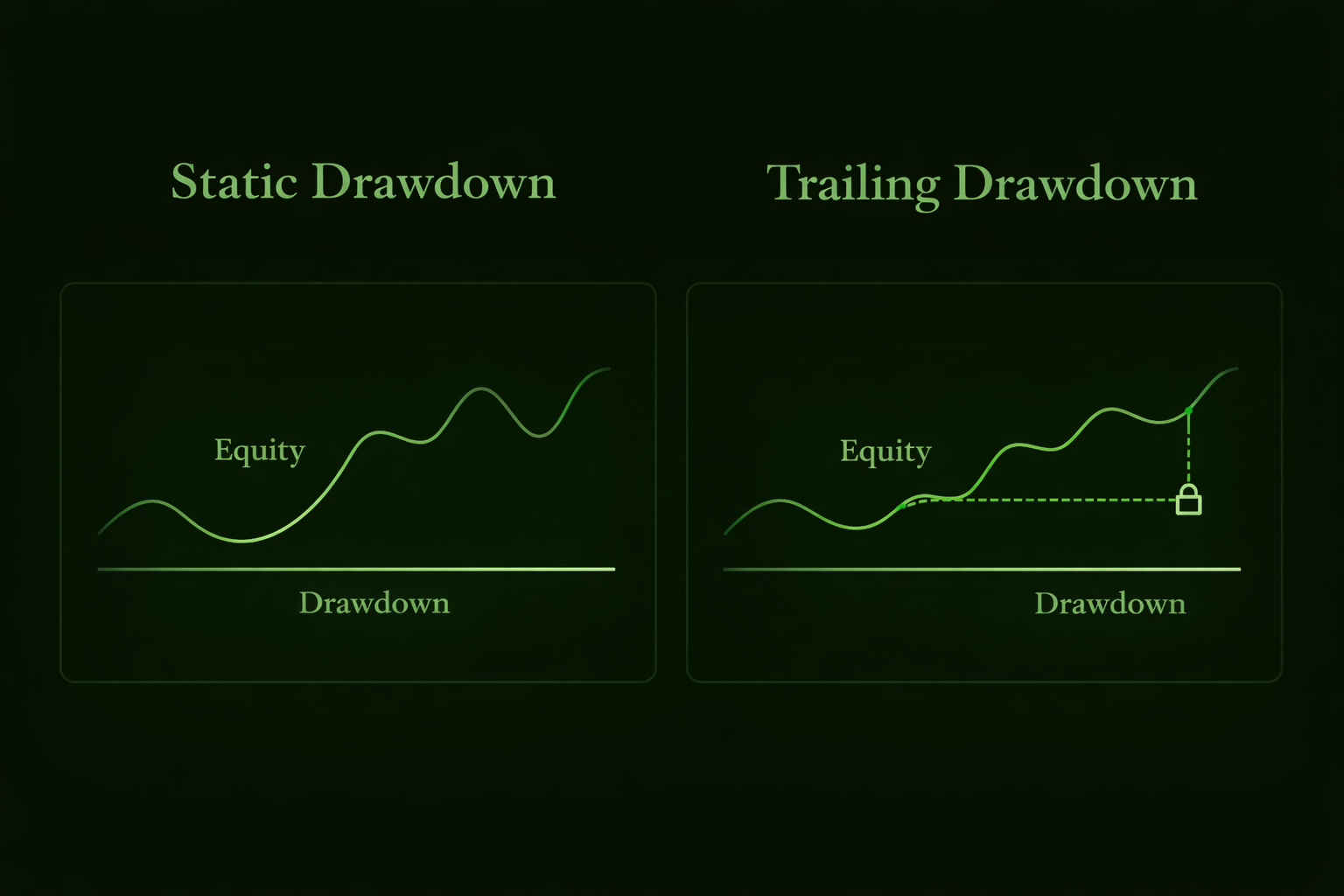

Static Drawdown Rules

Static drawdown stays fixed once the trader begins the challenge. It does not rise when the trader earns a profit.

Example of Static Drawdown

A 100,000 account with a 90,000 static limit gives a firm 10,000 of risk tolerance. If the trader grows the account to 115,000, the floor still holds at 90,000. This creates space for drawdowns, pullbacks, and multi-day trade plans.

Why Static Drawdown Works Well

• Extra cushion after profits • Pullbacks do not reduce remaining room • Good for swing or longer holds • Ideal for traders who scale into trends

Traders can build a buffer and protect the working room for later sessions.

Trailing Drawdown Rules

Trailing drawdown rises when the account reaches new highs. The limit moves upward to preserve the unrealized gain.

Example of Trailing Drawdown

Start: 100,000 Trailing cushion: 10,000 New high: 110,000 → floor rises to 100,000 New high: 113,000 → floor rises to 103,000 Equity slips to 108,000 → floor stays at 103,000

If the balance falls to the floor, the challenge ends.

Why Trailing Drawdown Is Tougher

• Winning streaks shrink buffer space • Pullbacks after a peak can wipe out the account • Traders must protect profits instead of giving them back

Trailing rules reward steady gains, not volatile swings.

Daily Loss Limits

The daily limit measures loss within one trading day. Even if the account is above the total drawdown, breaking the day limit ends the challenge.

Daily Loss Limit Rule Flow

Importance of Daily Limits

• Stops emotional spiraling • Prevents traders from “doubling down.” • Encourages knowing when to quit early

Daily limits punish impulsive behavior more than bad setups.

Balance-Based vs Equity-Based Drawdown

Some prop firms calculate drawdown using closed trades only. Others apply drawdown to live equity, which changes risk details dramatically.

Balance-Based

• Loss counts only after closing trades

• Unrealized drawdown is tolerated until exit

Equity-Based

• Unrealized drawdown counts

• Floating losses can trip limits even with long-term targets

Equity-based makes position management more sensitive.

Why Traders Break Drawdown Rules

Most drawdown failures come from: • Oversized trades • Ignoring pullback potential • No hard stop placement • Chasing losses to recover • Forgetting that trailing levels tighten over time

Prop firms design drawdown limits to expose weak habits. Traders who respect the ceiling stay alive long enough to reach payouts.

Matching Strategy to Drawdown Type

Best for Static Drawdown

• Position traders

• Breakout traders holding through retraces

• Traders with wider stops

• Those who prefer slow, deliberate setups

Best for Trailing Drawdown

• Scalpers

• Low-risk intraday traders

• Those comfortable taking quick exits

• Traders who do not leave trades floating

A mismatch between style and drawdown rules leads to fast failures.

How Drawdown Rules Shape Discipline

Prop firm drawdown rules force traders to: • Define risk before entry • Stop trading when limits are near • Avoid chasing losses • Trade fewer, higher-quality setups • Value capital protection above excitement

Success becomes a byproduct of respect for limits, rather than constant trading.

Final Takeaway on Prop Firm Drawdown Rules

Prop firm drawdown rules determine whether a trader survives challenges and reaches payouts. Static limits offer steady breathing room. Trailing systems rise behind gains and demand caution. Daily loss caps enforce patience, and equity tracking changes how trades can be managed. Learn the rules, trade within them, and treat the drawdown ceiling as the most valuable resource in funded trading, not just a number on the dashboard.