Is Prop Trading Worth It

Learn whether prop trading is worth it, including pros, cons, rules, fees, payouts, and which traders succeed with funded accounts versus those who struggle.

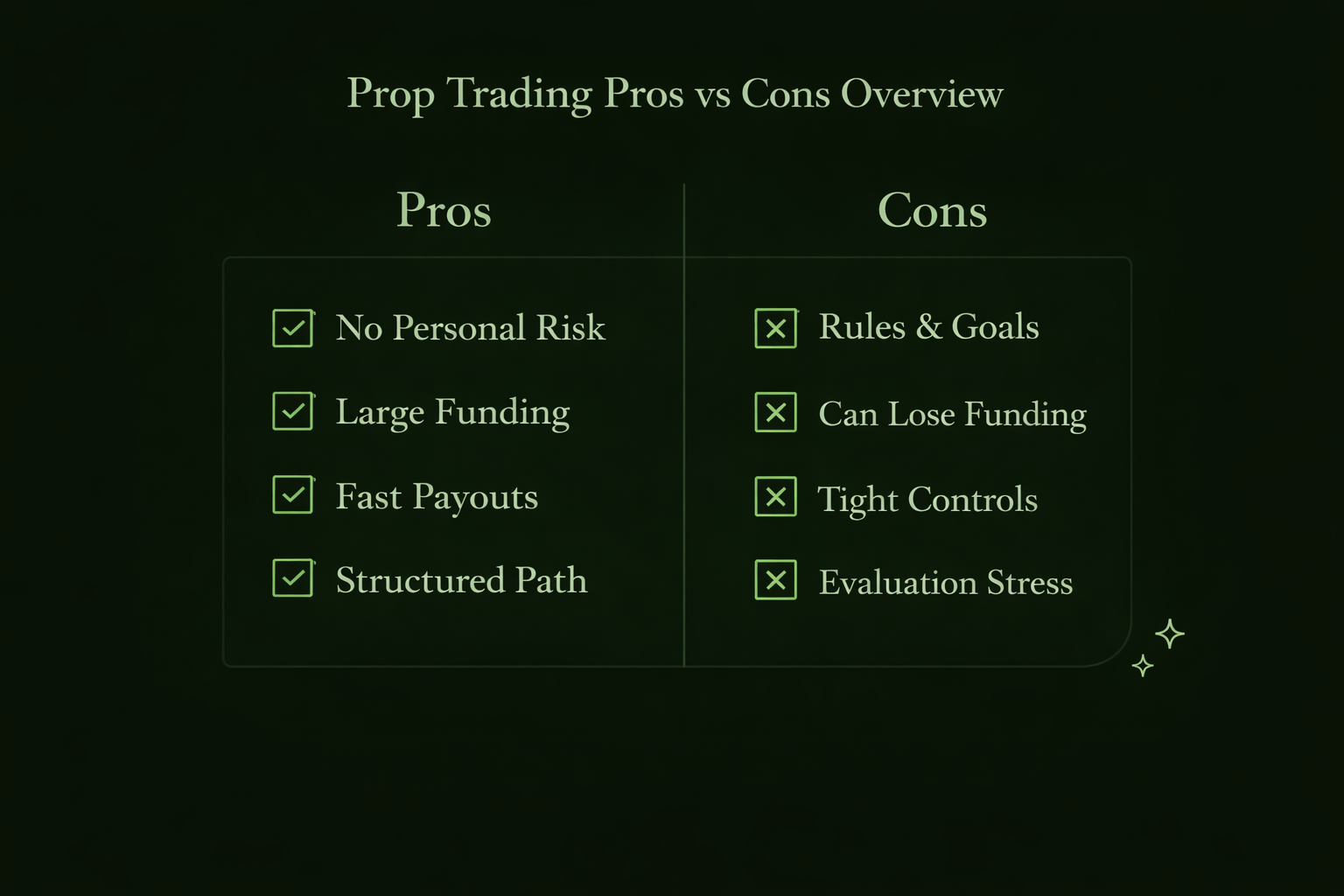

Is Prop Trading Worth It? is a question every trader should answer with a clear understanding of how funding firms operate. Prop companies attract traders with the opportunity to trade large accounts and grow their income without risking personal funds. However, funded trading comes with rules, drawdown limits, and fee structures that determine whether the experience leads to success or repeated challenges and failures. Understanding the tradeoffs helps decide if prop trading supports your goals or slows progress.

What Makes Prop Trading Appealing

Prop firms fill a gap for traders who have the skill but not enough capital. Instead of saving for years to build a large balance, a trader can access buying power once they pass a firm evaluation.

Major Advantages

• Trade with firm money, not personal cash • Limited downside risk • Access to accounts larger than most traders can fund themselves • Payout splits reward profits • Some firms offer account scaling based on performance

Prop trading can speed up opportunities for traders who prove consistency.

The Hidden Rules Behind Prop Trading

Prop firms regulate trader behavior through structured evaluation programs. Passing requires more than a profitable system.

Common rule types include:

• Max daily loss

• Total drawdown limits

• Trailing or static drawdown

• Lot or contract caps

• News restrictions

• Position timing limits

• Verification phases

Many traders fail not from the wrong direction but from breaking these rules.

Why Prop Trading Is Harder Than It Looks

Prop trading demands tight discipline. A trader may know how to win in a casual environment but struggle under hard limits.

Challenges include:

• Small drawdown windows

• Strict daily boundaries

• No room for large swings

• Pressure to reach a set target before time runs out

The evaluation exposes habits quickly.

Does Prop Trading Pay Enough to Matter

Prop payouts can offer meaningful income if the trader reaches funded status and protects the account.

Benefits include:

• Little or no personal capital at risk

• Clear percentage shares of profit

• Fast path to large account size

• Ability to earn more than a small personal account allows

But payouts only arrive if you follow the rules and trade consistently.

Fee Structure Matters

Prop trading is not free. Traders may pay:

• Upfront fees for evaluations, or

• Activation and platform fees in pay-later programs

A trader who fails multiple evaluations quickly learns that skill is cheaper than repetition.

Managing cost and risk together determines long-term value.

The Right Trader for Prop Firms

Prop trading is worth it for:

• Traders with a back-tested method

• People who respect rules

• Those who size trades properly

• Individuals who can walk away during losing streaks

• Traders who prefer defined risk

These traders often reach funding and scale accounts.

Who Prop Trading Is For vs Not For

Who Should Avoid Prop Firms

Prop trading may not help if: • You lack a clear system • You cannot stick to stop-loss rules • You tilt emotionally when losing • You rush goals instead of working patiently • You are still in early learning stages

In these cases, personal practice accounts may be safer until habits improve.

Prop Trading vs Traditional Retail Trading

Retail trading gives full control but also full risk exposure. You can hold through deep drawdowns, scale sizes freely, and trade during volatile news—but you are risking your own money.

Prop trading reduces personal financial danger but limits freedom. The structure can help traders avoid overexposure but demands reliability.

Honest Answer to Is Prop Trading Worth It

Prop trading is worth it if you have discipline, know your method, and treat trading like a business instead of entertainment. It offers an opportunity with reduced financial risk and a clear path to scale up. But it is not a shortcut and will frustrate anyone expecting fast money without structure

Final Takeaway on Is Prop Trading Worth It

Is Prop Trading Worth It depends entirely on who is asking. For prepared traders who follow rules, protect capital, and trade patiently, funded accounts can amplify earnings and cut risk. For unprepared traders, prop challenges can drain money and confidence quickly. Build consistency first, then choose a firm, and prop trading becomes a viable path to growth instead of a gamble.