How Prop Firm Evaluations Work

Learn how prop firm evaluations work, step-by-step rules, drawdown limits, profit targets, and why traders pass or fail before accessing a funded account.

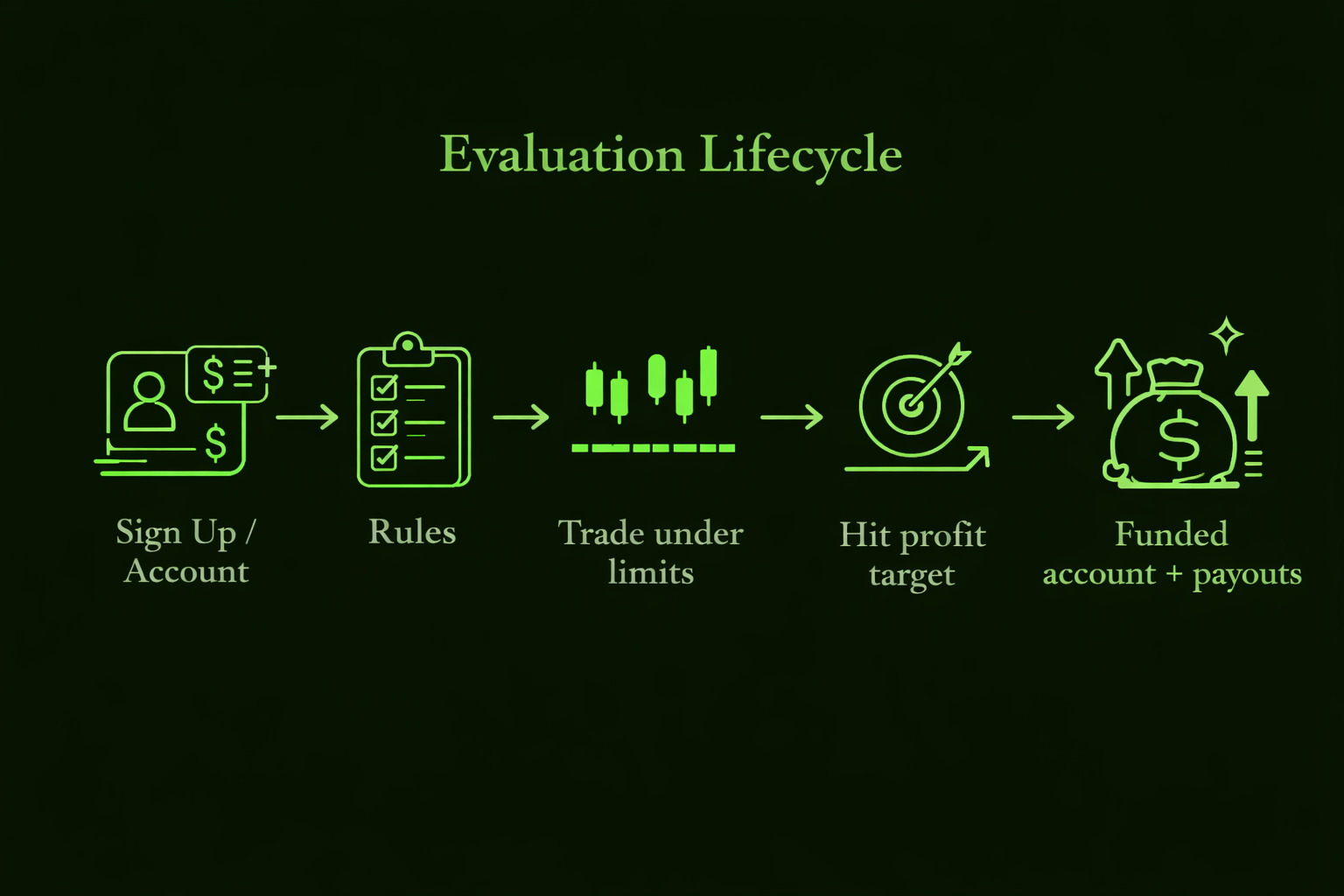

How prop firm evaluations work is one of the first questions traders ask before joining a proprietary trading firm. A prop firm evaluation is a testing phase where traders must follow defined rules, manage drawdown limits, and reach a profit target before qualifying for a funded account. This process is designed to measure discipline and risk control rather than speed or aggressive profit chasing.

This page explains how prop firm evaluations work step by step, the rules traders must follow, why many evaluations fail, and how different evaluation models affect trader behaviour and outcomes.

What Is a Prop Firm Evaluation

A prop firm evaluation is a qualification stage used to determine whether a trader can trade within strict risk limits. During this stage, traders operate a simulated account that mirrors live market conditions. The firm tracks performance, drawdown, and rule compliance in real time.

The evaluation is not meant to test how fast a trader can make money. It exists to confirm that the trader can follow rules consistently while managing risk under pressure. Only traders who meet all requirements pass and move on to a funded account.

How Prop Firm Evaluations Work Step by Step

While details vary between firms, the core structure of how prop firm evaluations work remains consistent across the industry.

Account Setup and Rule Review

After registration, the trader receives access to an evaluation account with a defined balance. The firm provides a full set of rules that explain profit targets, drawdown limits, daily loss limits, and restricted actions. These rules apply from the first trade and are enforced without exception.

Trading During the Evaluation Phase

The trader places trades under live market conditions while respecting all limits. Profit and loss are tracked continuously, and any rule violation results in immediate failure. This stage tests consistency, not one-time performance.

Reaching the Profit Target

To pass, the trader must reach a predefined profit target. This target is usually expressed as a percentage of the account balance. The target must be reached without breaching drawdown or daily loss limits.

Passing or Failing the Evaluation

If the profit target is reached within the rules, the evaluation is passed. If a rule is violated, the evaluation ends and is marked as failed. No partial passes exist in most evaluation structures.

Common Rules Used in Prop Firm Evaluations

Understanding the rules is essential to understanding how prop firm evaluations work.

Maximum Drawdown

Maximum drawdown defines the total loss the account can reach before failing. It may be calculated from the initial balance or from the highest equity level, depending on the firm’s structure.

Daily Loss Limit

Many prop firms set a daily loss limit. If losses exceed this amount in a single trading day, the evaluation fails regardless of overall performance.

Profit Target

The profit target specifies how much profit must be generated to pass. Reaching the target without respecting other rules does not count as a pass.

Time Restrictions

Some firms impose minimum or maximum trading days. Others allow unlimited time as long as the trader remains within the rules.

Static Drawdown vs Trailing Drawdown in Evaluations

Drawdown structure has a major impact on evaluation difficulty.

Static Drawdown

Static drawdown remains fixed throughout the evaluation. As profits increase, the distance between equity and the drawdown limit grows, giving traders more flexibility.

Trailing Drawdown

Trailing drawdown moves upward as the account reaches new equity highs. This structure requires traders to reduce risk as profits grow. Many traders fail trailing drawdown evaluations by maintaining the same position size after equity increases.

a side-by-side graphic showing:

- Static drawdown: fixed floor

- Trailing drawdown: floor moves up as equity highs increase Use two mini equity curves + a clearly labeled “liquidation/fail line” to make it obvious.

Why Most Traders Fail Prop Firm Evaluations

Many traders fail evaluations even with profitable strategies. The cause is often behavioral rather than technical.

Overtrading to Reach Targets Faster

Traders may increase trade frequency or position size to reach the profit target faster. This behavior increases the chance of drawdown breaches.

Poor Decisions Near Loss Limits

As traders approach drawdown limits, decision quality often declines. Risk increases at the worst possible time.

Pressure Created by Evaluation Fees

In upfront fee models, traders feel pressure to recover the evaluation cost. This pressure affects patience and rule compliance.

How Evaluation Models Affect Trader Behavior

The structure of an evaluation shapes how traders act during the test phase.

Upfront fee evaluations place financial risk on the trader before proof of performance. This often leads to rushed decisions and reduced discipline.

Models that allow traders to pass before paying reduce early pressure. Traders focus on rule compliance and consistency rather than recovering a fee.

Risk Management During a Prop Firm Evaluation

Risk management determines success more than strategy selection.

Position Size Control

Smaller risk per trade reduces the chance of breaching drawdown limits before reaching the profit target.

Trade Selection Discipline

Waiting for valid setups matters more than trade frequency during evaluations.

Protecting Equity Gains

When trailing drawdown is used, traders must reduce exposure as equity increases to avoid unnecessary failures.

What Happens After You Pass a Prop Firm Evaluation

After passing, the trader qualifies for a funded account. At this stage, profit splits apply and payouts become available based on the firm’s rules. Risk limits usually remain in place, but the trader is now trading firm capital rather than a test account.

How PropFunding Approaches Evaluations

PropFunding structures evaluations to focus on rule compliance, drawdown control, and consistent execution. The evaluation is designed to assess how traders manage risk under real market conditions rather than how quickly they reach a profit target.

Models that allow traders to pass before paying reduce early pressure and support disciplined decision making.

Is a Prop Firm Evaluation Worth It

For traders who want access to capital without risking personal funds, prop firm evaluations provide a clear path. Success depends on understanding how prop firm evaluations work, respecting the rules, and managing risk with discipline.

Final Thoughts on How Prop Firm Evaluations Work

Understanding how prop firm evaluations work is essential before choosing a proprietary trading firm. Evaluations reward discipline, patience, and risk control. Traders who prioritize consistency over speed have a higher chance of passing and sustaining long term results.